etp-itp.ru

Recently Added

Investment Banking Function

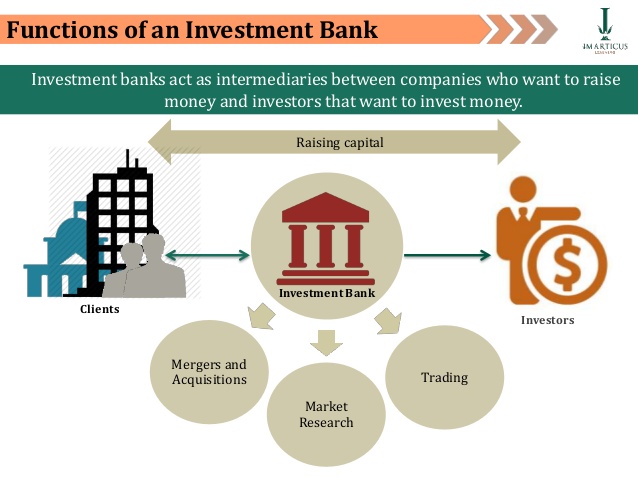

Investment banks perform two basic, critical functions. First, investment banks act as intermediaries between those entities that demand capital (eg. The role of an investment bank is two-fold – either selling or buying. On the sales side, investment banks help clients (usually those listed on the ASX) to. Investment banking is the division of a bank or financial institution that serves governments, corporations, and institutions by providing underwriting (capital. Investment banks generally cover several distinct areas: capital raising, through debt and equity instruments; financial advisory services, including M&A. As a leading independent global investment bank, our team has the agility to offer a wide range of advisory and capital raising services to both emerging and. Investment banks play an important role in capital formation and price setting. They also aid in the coordination of current and future consumption. The purpose of investment banks is to bring together 1) parties who have money and looking to invest their money to earn a return and 2) parties who need money. Investment banks are pivotal in aiding companies to raise capital through stock and bond issuance, offering expertise in pricing financial instruments and. Investment bankers are investment professionals who combine financial services industry expertise, analytical prowess, and effective persuasive communication. Investment banks perform two basic, critical functions. First, investment banks act as intermediaries between those entities that demand capital (eg. The role of an investment bank is two-fold – either selling or buying. On the sales side, investment banks help clients (usually those listed on the ASX) to. Investment banking is the division of a bank or financial institution that serves governments, corporations, and institutions by providing underwriting (capital. Investment banks generally cover several distinct areas: capital raising, through debt and equity instruments; financial advisory services, including M&A. As a leading independent global investment bank, our team has the agility to offer a wide range of advisory and capital raising services to both emerging and. Investment banks play an important role in capital formation and price setting. They also aid in the coordination of current and future consumption. The purpose of investment banks is to bring together 1) parties who have money and looking to invest their money to earn a return and 2) parties who need money. Investment banks are pivotal in aiding companies to raise capital through stock and bond issuance, offering expertise in pricing financial instruments and. Investment bankers are investment professionals who combine financial services industry expertise, analytical prowess, and effective persuasive communication.

Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals. Investment Banking &. The role of an investment bank is two-fold – either selling or buying. On the sales side, investment banks help clients (usually those listed on the ASX) to. Investment banks are typically split up into three distinct parts: the front office, middle office, and back office. Our leading global Investment Banking business delivers M&A and financing services that drive enduring success that transcends individual transactions. Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Both Capital Markets groups work closely with Corporate Banking and Investment Banking (client coverage) and Global Markets (trading and distribution). The principle role of an investment banker is to introduce lenders to companies in need of capital. Investment banks regularly cultivate business liaisons with. An investment banker acts in an advisory capacity, help clients raise money from capital markets in order to expand their businesses. They also have a role in. This investment banking function is a core job of an investment bank to guide the investor to purchase, manage his portfolio and to trade various securities. Financial Intermediation: Investment banks serve as intermediaries between investors and issuers, connecting capital providers with capital. Investment banks play a key role in the economy by helping clients with money to invest and generate a return from clients that need funds to support growth. In. Investment banks play a key role in helping companies and government entities obtain capital financing. As financial advisors to their clients, they help to. This is called “making a market” in a security, and this role falls under “Sales & Trading.” Gillette wants to raise some money for a new project. One option is. Global Corporate & Investment Banking capabilities · Mergers and acquisitions · Capital markets · Cash flow and efficiency · Growth and operations · International. Through IPOs, an investment bank plays a key role in connecting firms with potential investors. Investment banks provide stock underwriting services to. Investment banking is a specialized segment of the financial industry that facilitates large and complex financial transactions for corporations, governments. Definition: Investment banking is a special segment of banking operation that helps individuals or organisations raise capital and provide financial consultancy. As many investment banking functions still require costly human interventions due to regulatory complexity, legacy technology, and challenges around data. Investment banks are actively involved in mergers and acquisitions. These banks perform the functions of deal making, advising, and underwriting. Investment. The investment bankers are hired by companies to advise on the process, enabling them to take advantage of the investment bankers' specialist experience in.

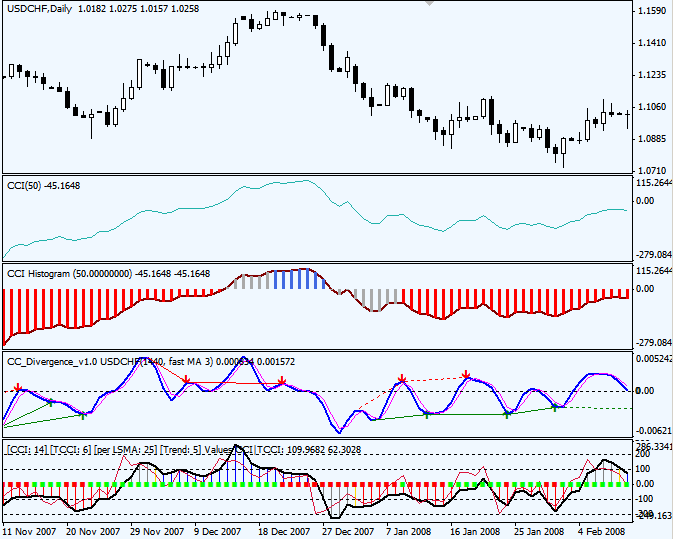

Cci Stock Indicator

The Commodity Channel Index (CCI) is a momentum-based oscillator that is used to assess when an investment vehicle has reached an overbought or oversold. In general, the CCI measures the current price level relative to an average price level over a given period of time. CCI is relatively high when prices are far. The Commodity Channel Index (CCI) indicator measures an asset's current price compared to the average price level established over a given period. CCI measures the variations in the price of a stock with respect to its statistical mean. Contrary to the meaning derived from its name, the CCI works well with. The CCI measures the difference between the last typical price [(high + low + close)/3] and the average of the means over a chosen period of time. Although originally intended for commodities it is now popularly used with other instruments including stocks. It indicates the level of the price relative to. The Commodity Channel Index (CCI) expresses variation of a security's price based on its statistical mean. Using the CCI can help you identify excess buying or. The Commodity Channel Index is a technical analysis tool that will help you to trade more effectively. Learn more about it in our educational guide. Confirm the. The CCI (Commodity Channel Index) was developed in by Donald Lambert. This indicator is an oscillator that helps to identify overbought or oversold markets. The Commodity Channel Index (CCI) is a momentum-based oscillator that is used to assess when an investment vehicle has reached an overbought or oversold. In general, the CCI measures the current price level relative to an average price level over a given period of time. CCI is relatively high when prices are far. The Commodity Channel Index (CCI) indicator measures an asset's current price compared to the average price level established over a given period. CCI measures the variations in the price of a stock with respect to its statistical mean. Contrary to the meaning derived from its name, the CCI works well with. The CCI measures the difference between the last typical price [(high + low + close)/3] and the average of the means over a chosen period of time. Although originally intended for commodities it is now popularly used with other instruments including stocks. It indicates the level of the price relative to. The Commodity Channel Index (CCI) expresses variation of a security's price based on its statistical mean. Using the CCI can help you identify excess buying or. The Commodity Channel Index is a technical analysis tool that will help you to trade more effectively. Learn more about it in our educational guide. Confirm the. The CCI (Commodity Channel Index) was developed in by Donald Lambert. This indicator is an oscillator that helps to identify overbought or oversold markets.

The Commodity Channel Index measures the position of price in relation to its moving average. This can be used to highlight when the market is overbought/. CCI fits into the momentum category of oscillators. In addition to momentum, volume indicators and the price chart may also influence a technical assessment. The Commodity Channel Index (CCI) is used to determine the overbought or oversold conditions in the market. The CCI has been one of the most commonly used. The CCI Indicator, short for Commodity Channel Index, stands as a pivotal technical analysis instrument in the financial markets. Introduced. The Commodity Channel Index (CCI) measures the variation of a security's price from its statistical mean. High values show that prices are unusually high. The Commodity Channel Index (CCI 20) is a momentum-based technical indicator that spots price reversals, price extremes and trend strength. Conversely, CCI values above + indicate an overbought security/index and can be used as a "Sell" signal. Furthermore, these overbought oversold indicators. Learn to trade through Commodity Channel Index (CCI) indicator Technical Analysis tool w/case studies for Stock Trading. Commodity Channel Index indicator oscillates around the naught line tending to stay within the range from to + The naught line represents the level of. The Commodity Channel Index (CCI) is a versatile indicator that can be used to identify a new trend or warn of extreme conditions. CCI fits into the momentum category of oscillators. In addition to momentum, volume indicators and the price chart may also influence a technical assessment. The Commodity Channel Index (CCI) is a technical indicator that measures the current price level relative to an average price level over a given period of time. Commodity Channel Index (CCI). The Commodity Channel Index (CCI) is a momentum oscillator used in technical analysis that measures an instrument's variations. Lambert focused on movement above + and below He considers a move above + a buy signal as the Commodity Channel Index tells him that the commodity. The CCI indicator is a useful tool that helps spot divergences, identify overbought/oversold market levels and trading signals. Start trading with Blueberry. The Commodity Channel Index (CCI) expresses variation of a security's price based on its statistical mean. The CCI measures a price and identifies how far away from a moving average it is extending, and how fast it moved to get there. It takes a standard deviation of. The CCI technical indicator must be used in combination with other oscillators in order to offer traders reasonable signals to estimate changes in the direction. The CCI measures the difference between a security's average price and its current price relative to its volatility. CCI values above + or. CCI represents the position of current price relative to the average of price over a recent period. Lambert discussed CCI in detail in a article in Stocks.

Is It Worth It To Refinance Your Mortgage

Whether you're looking to shorten your term, lower your monthly payment, consolidate debt or cash-out equity, choose Solarity Credit Union. We make refinancing. You should refinance your mortgage if interest rates have dropped, if you want to consolidate debt, or if you want to access equity in your home. Somethings. One of the primary benefits of refinancing is the ability to reduce your interest rate. A lower interest rate may mean lower mortgage payments each month. Plus. For borrowers with a perfect credit history, refinancing can be a good way to convert a variable loan rate to a fixed, and obtain a lower interest rate. Refinancing your mortgage can lower your interest rate, pay off debts, and allow access to existing equity, but it can also introduce new financial risks. But as a general rule, refinancing can be worthwhile if you can get an interest rate at least two percentage points lower than your current rate. Even if rates. Generally the rule thumb is "refinance for 1 1/2% or more of a drop". That just kind of a guide, but in your case, you have all the numbers you. A refinance replaces an existing loan with a new mortgage that offers a lower interest rate or better terms — saving you money. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out. Whether you're looking to shorten your term, lower your monthly payment, consolidate debt or cash-out equity, choose Solarity Credit Union. We make refinancing. You should refinance your mortgage if interest rates have dropped, if you want to consolidate debt, or if you want to access equity in your home. Somethings. One of the primary benefits of refinancing is the ability to reduce your interest rate. A lower interest rate may mean lower mortgage payments each month. Plus. For borrowers with a perfect credit history, refinancing can be a good way to convert a variable loan rate to a fixed, and obtain a lower interest rate. Refinancing your mortgage can lower your interest rate, pay off debts, and allow access to existing equity, but it can also introduce new financial risks. But as a general rule, refinancing can be worthwhile if you can get an interest rate at least two percentage points lower than your current rate. Even if rates. Generally the rule thumb is "refinance for 1 1/2% or more of a drop". That just kind of a guide, but in your case, you have all the numbers you. A refinance replaces an existing loan with a new mortgage that offers a lower interest rate or better terms — saving you money. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out.

Refinancing happens when you pay off your current mortgage with money from a new mortgage. Often homeowners refinance to try to lower the cost of their mortgage. Maybe you want to lower your monthly payment, change the loan term, get a lower interest rate, or tap into your home equity for other expenses. A general guideline for determining whether you should refinance your mortgage is that you should do it only if you can lower your interest rate by at least 2%. There are many different reasons to refinance your home, ranging from taking out extra money to financing renovations, to consolidating debt. Refinancing can save you money if you get a lower interest rate, but you could also end up paying more if you refinance simply to extend the loan term. Without a lower interest rate, it might not be worth refinancing. If you refinance into a higher interest rate, that means larger monthly payments and more. Homeowners typically think about refinancing when current interest rates are lower than the rate on their mortgages. A lower interest rate might help them. Most experts recommend refinancing a mortgage if you can lower your current interest rate by at least to 1 percent. Refinance Your Mortgage and Save · Get a Better Loan. Refinance to a lower rate or pay off your loan faster with a shorter term. · Take Cash Out. Use the equity. Refinancing will reduce your monthly mortgage payment by $ By refinancing, you'll pay $48, more in the first 5 years. Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest. A general guideline for determining whether you should refinance your mortgage is that you should do it only if you can lower your interest rate by at least 2%. The accepted rule of thumb has always been that it was only worth refinancing if you could reduce your interest rate by at least 2%. The benefits of refinancing your mortgage which may include: · Reduce monthly mortgage payments · Get a lower interest rate · Convert your home equity into cash. Refinancing can help you save money by taking advantage of interest rates that are lower than when you originally bought your home. If mortgage rates are lower than when you closed on your current mortgage, refinancing could reduce your monthly payments and the total amount of interest you. If interest rates have gone down and you decide to pay off your mortgage sooner than your current terms, you may want to refinance your mortgage for a shorter. If interest rates fall after you close on your loan, you could consider refinancing to take advantage of the lower rate. You might save thousands of dollars. The most common reason for a mortgage refinance is to lower a mortgage loan rate. While each homeowner has their own reasons for refinancing.

Real Estate Investment Guide

etp-itp.ru: The Complete Guide to Real Estate Finance for Investment Properties: How to Analyze Any Single-Family, Multifamily, or Commercial Property. Real estate has become a popular investment vehicle over the last 50 years or so. Here's a look at some of the leading options for individual investors. There are several low-cost ways to invest in real estate that could help you diversify your portfolio and hedge against inflation. In this guide, our experts here at Kenwood Management Company will provide an overview of the commercial real estate market, critical factors to consider, and. The Ultimate Beginner's Guide to Getting Started will give you an insider's look at the many different real estate investing strategies that are out there. What are Real Estate Investment Funds? Private real estate investment funds are a type of investment vehicle that pools capital from multiple investors to buy. How to Start Investing in Real Estate: The Basics · 1. Land speculation · 2. Property flipping · 3. Short-term rentals · 4. Small-scale residential rental. real estate strategy and operations. We have created the Global Corporate Real Estate Guide with the belief that, whether you are an investor or an occupier. Many investment methods have emerged, such as rental property, fix-and-flip, crowdfunding, REIT, JV partnership, and wholesaling. etp-itp.ru: The Complete Guide to Real Estate Finance for Investment Properties: How to Analyze Any Single-Family, Multifamily, or Commercial Property. Real estate has become a popular investment vehicle over the last 50 years or so. Here's a look at some of the leading options for individual investors. There are several low-cost ways to invest in real estate that could help you diversify your portfolio and hedge against inflation. In this guide, our experts here at Kenwood Management Company will provide an overview of the commercial real estate market, critical factors to consider, and. The Ultimate Beginner's Guide to Getting Started will give you an insider's look at the many different real estate investing strategies that are out there. What are Real Estate Investment Funds? Private real estate investment funds are a type of investment vehicle that pools capital from multiple investors to buy. How to Start Investing in Real Estate: The Basics · 1. Land speculation · 2. Property flipping · 3. Short-term rentals · 4. Small-scale residential rental. real estate strategy and operations. We have created the Global Corporate Real Estate Guide with the belief that, whether you are an investor or an occupier. Many investment methods have emerged, such as rental property, fix-and-flip, crowdfunding, REIT, JV partnership, and wholesaling.

In this comprehensive guide, we will delve into various crucial aspects that every prospective commercial real estate investor should consider. In this guide, we break down the essentials of commercial real estate investing, explore the benefits and risks, and provide actionable steps to get you. There are several low-cost ways to invest in real estate that could help you diversify your portfolio and hedge against inflation. We are offering tips, advice, beginner-friendly strategies, terminology, and mistakes to avoid. You'll want to keep this real estate investing guide handy. 5 Simple Ways to Invest in Real Estate. Here's how—from buying rental property to REITs and more. How to Start Investing in Real Estate: The Basics · 1. Land speculation · 2. Property flipping · 3. Short-term rentals · 4. Small-scale residential rental. These investment guides are valuable resources and include content such as Core/Core-Plus Funds, Value-Added Funds, Opportunistic Funds, International Funds. Pros · No landlord duties: Passive investors in real estate only provide investment capital, rather than engaging in the operations and maintenance of a. This comprehensive guide is designed to walk beginners through the process of getting started in real estate investing. This guide illuminates 11 such time-honored techniques, each one a thread weaving through the fabric of real estate success stories. A REIT (real estate investment trust) is a company that makes investments in income-producing real estate. Asia commercial real estate investment guide. We have assisted clients for decades in structuring their real estate deals involving a wide range of asset. Equity REITs are real estate companies that own or manage income-producing properties Learn how best to invest in this type of REIT and more today. This article is a comprehensive guide to help you take on buy-and-hold property investing, from how to find the right property to becoming a landlord. Investing in Real Estate. Investment real estate is land and other real property that generates income for its owner instead of a place to live. Learn how. MORE BENEFITS. Access to time-saving, and hassle-free assistance to help you navigate the real estate investment process GUIDE TO REAL ESTATE IRA INVESTING. Investing > Stock Market > Market Sectors > Real Estate Investing. How to Invest in Real Estate: A Complete Guide. By Matthew DiLallo – Updated Jul 3, at. Fractional real estate investing is a game-changing approach that allows investors to own shares in a property without buying it outright. This guide. etp-itp.ru: The Complete Guide to Real Estate Finance for Investment Properties: How to Analyze Any Single-Family, Multifamily, or Commercial Property. Our guide offers insights into market trends, investment strategies, and tips for navigating the local landscape in Carlsbad.

Best Gaming Coins

From established names to emerging stars, the best crypto gaming coins for offer unique value propositions and growth potential. Game Coins – book them in advance for the best deals and easy playing. Enjoy classic funfair games, try your hand at basketball or shooting, race penguins. Explore the top Gaming (GameFi) crypto coins. View this category's crypto coin prices, charts, total market cap, 24h volume and more. Virtuaswap is a dedicated wallet app for managing your accounts, earning referral bonuses, store rewards and NFT game assets. JUP, SOL, HBAR, LTC, ADA, FTM. Actually, they all usually do pretty well in a bull market. Gaming, and artificial intelligence projects are. PlayToEarn is the best source to find Play-To-Earn Crypto & NFT Blockchain Games. Earn Cryptocurrency & NFTs playing Ethereum & Bitcoin Games. Gaming Cryptos · Immutable IMX · FLOKI FLOKI · Notcoin NOT · Flow FLOW · Axie Infinity AXS · Gala GALA · Beam BEAM · The Sandbox SAND. COIN Series · A Distant Plain, 4th Printing · A Fading Star: Insurgency and Piracy in Somalia · All Bridges Burning: Red Revolt and White Guard in Finland, Discover top gamefi tokens and gaming coins prices, market cap, charts, volume, and more. From established names to emerging stars, the best crypto gaming coins for offer unique value propositions and growth potential. Game Coins – book them in advance for the best deals and easy playing. Enjoy classic funfair games, try your hand at basketball or shooting, race penguins. Explore the top Gaming (GameFi) crypto coins. View this category's crypto coin prices, charts, total market cap, 24h volume and more. Virtuaswap is a dedicated wallet app for managing your accounts, earning referral bonuses, store rewards and NFT game assets. JUP, SOL, HBAR, LTC, ADA, FTM. Actually, they all usually do pretty well in a bull market. Gaming, and artificial intelligence projects are. PlayToEarn is the best source to find Play-To-Earn Crypto & NFT Blockchain Games. Earn Cryptocurrency & NFTs playing Ethereum & Bitcoin Games. Gaming Cryptos · Immutable IMX · FLOKI FLOKI · Notcoin NOT · Flow FLOW · Axie Infinity AXS · Gala GALA · Beam BEAM · The Sandbox SAND. COIN Series · A Distant Plain, 4th Printing · A Fading Star: Insurgency and Piracy in Somalia · All Bridges Burning: Red Revolt and White Guard in Finland, Discover top gamefi tokens and gaming coins prices, market cap, charts, volume, and more.

List of Gaming Cryptocurrencies · STEPN ($GMT) · ILLUVIUM ($ILV) · WEMIX ($WEMIX) · RONIN (RON) · OASYS (OAS) · GODS UNCHAINED ($GODS) · STAR ATLAS ($POLIS) · FLOW ($. Top Play To Earn Tokens by Market Capitalization. Listed below are the top crypto coins and tokens used for Play To Earn. They are listed in size by market. Top Gaming (GameFi) Coins & Tokens by Market Cap ; Aavegotchi (GHST). GHSTAavegotchi. $ +%. Trade ; Mobox (MBOX). MBOXMobox. $ +%. Trade. Virtuaswap is a dedicated wallet app for managing your accounts, earning referral bonuses, store rewards and NFT game assets. Explore the top 50 list of popular Gaming crypto coins, used in blockchain games and ranked by market cap. Gambling Cryptos · WINk WIN · Shuffle SHFL · FUNToken FUN · BFG Token BFG · Aryacoin AYA · Decentral Games DG · Revain REV · Dotmoovs MOOV. boardgame geek · 1. 7 Wonders · 2. 7 Wonders · 3. 7 Wonders Duel · 4. Age of Conan: The Strategy Board Game – Adventures in Hyboria · 5. Akrotiri · 6. Alchemists · 7. An in-depth look at the top gaming coins to consider investing in this year. Here's what you need to know. It is also recommended to buy game coins from experienced trader, as it can offer good customer support and cheaper prices. etp-itp.ru is the best online. What is Gaming (GameFi) ; FLOKI logo. FLOKI. 2. FLOKI · $ ; Notcoin logo. Notcoin. 3. NOT · $ ; GALA logo. GALA. 4. GALA · $ Check out the top Gaming coins with latest price and 24 hour trading volume. Find the Gaming daily gainers and losers. Top 5 Best Gaming Currencies: Enjin (ENJ), Enjin is propelling the crypto game into an exciting new frontier. Thanks to the various play-to-earn blockchain games, you will earn numerous in-game rewards or tokens. Get started today with one of these top 10 gaming coins. We present a comprehensive guide to the top 10 gaming crypto coins based on market capitalization, shedding light on their unique features and potential for. Gaming ; SUPER. SUPER. % ; BIGTIME. BIGTIME. % ; MAX. MAX. % ; MAVIA. MAVIA. % ; AXS. AXS. %. When determining the best gaming tokens to purchase, it's imperative to consider a range of essential criteria that can significantly impact the potential. 6 Best Hardware Wallets for Top Crypto Wallets Reviewed! Can You Still ETH Word Game Black Sweatshirt. $55 · visit shop · Coin Bureau. Free Crypto. All people have experienced gambling in their life. It is exciting, jovial, and memorable. It becomes more interesting when it combines with the motive. Top Gaming Blockchains Coins Today By Market Cap ; 4. Enjin Coin. . ENJ.) $ +%, +% ; 5. SKALE. . SKL.) $ +%, +%. Top Gaming (GameFi) Coins & Tokens by Market Cap ; Aavegotchi (GHST). GHSTAavegotchi. $ +%. Trade ; Mobox (MBOX). MBOXMobox. $ +%. Trade.

Cashback From Credit Card

Every Capital One cash back credit card gives you a percentage back for all qualifying purchases—so you can get rewarded for every dollar you spend. How to redeem cash back · Statement credit: Apply cash back as a credit to your account balance. · Direct deposit or check: You can often transfer cash back to. I paid with a Discover Credit card at my grocery store and was offered a cash back option. Is there any reason why I shouldn't use it? BECU offers a Low Rate credit card and a Cash Back rewards credit card that offers % cash back on every purchase. BECU also offers affinity card designs. With the Bank of America® Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other purchases. Card Features: · % to 2%1 cash rebate on purchases · Variable annual percentage rates from %% · 0% Introductory rate for 6 months for qualified. Put money back in your wallet on each eligible purchase using the best cash back credit cards available from Bankrate's partners. With the U.S. Bank Cash+® Visa cash back credit card, you can earn 5% cash back on your first $2, in eligible net purchases each quarter on the combined two. Wells Fargo Active Cash® Card: Best for Flat-rate cash back · Chase Freedom Unlimited®: Best for All-around cash back · Discover it® Cash Back: Best for Quarterly. Every Capital One cash back credit card gives you a percentage back for all qualifying purchases—so you can get rewarded for every dollar you spend. How to redeem cash back · Statement credit: Apply cash back as a credit to your account balance. · Direct deposit or check: You can often transfer cash back to. I paid with a Discover Credit card at my grocery store and was offered a cash back option. Is there any reason why I shouldn't use it? BECU offers a Low Rate credit card and a Cash Back rewards credit card that offers % cash back on every purchase. BECU also offers affinity card designs. With the Bank of America® Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other purchases. Card Features: · % to 2%1 cash rebate on purchases · Variable annual percentage rates from %% · 0% Introductory rate for 6 months for qualified. Put money back in your wallet on each eligible purchase using the best cash back credit cards available from Bankrate's partners. With the U.S. Bank Cash+® Visa cash back credit card, you can earn 5% cash back on your first $2, in eligible net purchases each quarter on the combined two. Wells Fargo Active Cash® Card: Best for Flat-rate cash back · Chase Freedom Unlimited®: Best for All-around cash back · Discover it® Cash Back: Best for Quarterly.

With a cash back credit card from Wells Fargo, you earn cash back in the form of cash rewards for purchases you make. Earn unlimited cash rewards on purchases. Citi Custom Cash® Card · 5% |or 1%Cash Back · Low intro APRon purchases & balance transfers · No annual fee. Credit card cash back rewards are bonuses provided to credit card customers when they use their cards to make purchases. I paid with a Discover Credit card at my grocery store and was offered a cash back option. Is there any reason why I shouldn't use it? There are several ways to get cash back from your credit card. You can withdraw money at an ATM or receive convenience checks from your card issuer that, when. There are several ways to get cash back from your credit card. You can withdraw money at an ATM or receive convenience checks from your card issuer that, when. Earn cash every time you make a purchase with a DATCU Cash Back Visa® Card. Apply online, app, or branch to enjoy credit card rewards. Supported Carrier List Bread Cashback™ American Express® Credit Card Account Website. Select to be redirected to Sign in to manage your account. New here? Earn % cash back on every purchase with the Huntington Cash Back Credit Card. Learn more about the cash back card benefits and apply online or in branch. Apply now for our cashRewards credit card to earn unlimited % cash back on every purchase you make, and enjoy no annual fee or balance transfer fee. Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly. Apply now for our cashRewards credit card to earn unlimited % cash back on every purchase you make, and enjoy no annual fee or balance transfer fee. TTCU Visa® Cash Back credit card holders can earn up to % back on all purchase plus enjoy extra benefits. Learn more of what we have to offer! The BMO Cash Back Credit Card lets you earn unlimited cash back on purchases* with no annual fee! See our exclusive welcome offer to earn cash bonus! BECU offers a Low Rate credit card and a Cash Back rewards credit card that offers % cash back on every purchase. BECU also offers affinity card designs. A cash back credit card allows you to earn a percentage of your card spending back and redeem your rewards for checks, bank deposits or statement credits. You. Cash back programs are designed by credit card companies to reward loyal customers by adding an incentive for them to continue using the credit card. As long as. Card Features: · % to 2%1 cash rebate on purchases · Variable annual percentage rates from %% · 0% Introductory rate for 6 months for qualified. Earn 2% unlimited cash back on purchases with the Bread Cashback™ American Express® Credit Card. Enjoy entertainment perks, dining discounts, no annual fee. on up to $1, in combined purchases each quarter, automatically Earn unlimited 1% cash back on all other purchases. Learn More.

5 Year Treasury Index

The CMT yield values are read from the par yield curve at fixed maturities, currently 1, 2, 3, 4 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This. Data Disclaimer: The Nasdaq Indices and the Major Indices are delayed at least 1 minute. Data powered by Quotemedia. Nasdaq link logo Powered by Nasdaq Data. Treasury Inflation Protected Securities (TIPS) ; GTII5:GOV. 5 Year. ; GTIIGOV. 10 Year. ; GTIIGOV. 20 Year. ; GTIIGOV. 30 Year. Fund Risks: · Index Related Risk: · ICE BofA Current 5-Year US Treasury Index · Average Yield to Maturity · Effective Duration · Premium/Discount · Median 30 day. Year Government Bond Yields ; % · % · % · % ; -6 · -4 · -3 · Historical prices and charts for U.S. 5 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD05Y price Indexes: Index quotes may be. TMUBMUSD05Y | View the latest U.S. 5 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ. In depth view into 5 Year Treasury Rate including historical data from to , charts and stats. Graph and download economic data for Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis (DGS5) from. The CMT yield values are read from the par yield curve at fixed maturities, currently 1, 2, 3, 4 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This. Data Disclaimer: The Nasdaq Indices and the Major Indices are delayed at least 1 minute. Data powered by Quotemedia. Nasdaq link logo Powered by Nasdaq Data. Treasury Inflation Protected Securities (TIPS) ; GTII5:GOV. 5 Year. ; GTIIGOV. 10 Year. ; GTIIGOV. 20 Year. ; GTIIGOV. 30 Year. Fund Risks: · Index Related Risk: · ICE BofA Current 5-Year US Treasury Index · Average Yield to Maturity · Effective Duration · Premium/Discount · Median 30 day. Year Government Bond Yields ; % · % · % · % ; -6 · -4 · -3 · Historical prices and charts for U.S. 5 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD05Y price Indexes: Index quotes may be. TMUBMUSD05Y | View the latest U.S. 5 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ. In depth view into 5 Year Treasury Rate including historical data from to , charts and stats. Graph and download economic data for Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis (DGS5) from.

Graph and download economic data for 5-Year Treasury Constant Maturity Minus Federal Funds Rate (T5YFF) from to about yield curve. Indexes Finder. Morningstar US Yr Treasury Bond. Portfolio Key: The index measures the performance of fixed-rate, investment-grade USD-denominated. US Treasury yields and swap rates, including the benchmark year US Treasury Bond, the Secured Overnight Financing Rate (SOFR), 1-month Term SOFR swap rates. 1 YR. , 2 YR. , 3 YR. , 5 YR. , 7 YR. , 10 YR. , 12 YR. , US Treasury Yield Curve. TTM . Find the latest Treasury Yield 5 Years (^FVX) stock quote, history, news and other vital information to help you with your stock trading and investing. The official name of this index is "Yield on U.S. Treasury Security Adjusted to a Constant Maturity of One Year" (or 6 months, or 2 years, etc.). Confusion can. US 10 Year Note Bond Yield was percent on Tuesday September 3, according to over-the-counter interbank yield quotes for this government bond maturity. The current 5 year treasury yield as of August 29, is %. But high long-term yields can also be a sign of rising inflation expectations. Key Takeaways. Treasury yields are the interest rates that the U.S. government. Change Percent % ; Coupon Rate % ; Maturity Aug 15, ; 5 Day. ; 1 Month. The S&P U.S. Treasury Bond Current 5-Year Index is a one-security index comprising the most recently issued 5-year U.S. Treasury note or bond. Open%. Day Range ; 52 Wk Range - Price ; Change0/ Change Percent ; Coupon Rate%. Maturity. The constant maturity yield values are read from the yield curve at fixed maturities, currently 1, 3, and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This. Discover historical prices for ^FVX stock on Yahoo Finance. View daily, weekly or monthly format back to when Treasury Yield 5 Years stock was issued. This page provides monthly data & forecasts of the 5 year Treasury bill yield, the effective annualized return rate for Treasury debt with a constant 5-year. Treasury Inflation-Protected Securities (TIPS) are available both as medium and long-term securities. They mature in 5, 10, or 30 years. Like bonds and notes. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. 5, 10, or 30 years · The rate is fixed at auction and is never less than %. Treasury TIPS auction rules allow for negative real yield bids. See "Information. At that time Treasury released 1 year of historical data. View the Daily Treasury Par Real Yield Curve Rates · Daily Treasury Bill Rates. These rates are. US 1-YR. , US 2-YR. , + US 3-YR. , + US 5-YR. , + US 7-YR. , + US YR. , + US YR.

Regulated Forex Brokers For Us Clients

IG is a well-established broker that offers a range of trading services, including forex, stocks, indices, and commodities. They are regulated. Since futures include the currency market, the CFTC “naturally” protects forex traders as well. From to the present, the CFTC has undergone many changes in. According to the US spot Forex market regulations, only properly registered brokers may solicit and offer service to residents of the USA. The same regulations. There are very few Forex brokers operating in the United States. Only brokers regulated by the Commodity Futures Trading Commission (CFTC) can offer. We have been a registered Futures Commission Merchant (FCM) and Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC) and. My top pick: etp-itp.ru — /10 (Best forex broker for US clients). etp-itp.ru offers the most complex trading tools on the simplest trading platforms in. An extensive list of the best Forex Brokers accepting US traders or citizens of the USA. Including both Forex brokers in the USA and abroad. These saviors are the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). CFTC Homepage Screenshot. The CFTC regulates the. We've chosen OANDA as the best of the US-regulated forex brokers due to its accessible trading platform, excellent reputation and competitive trading fees. 1. IG is a well-established broker that offers a range of trading services, including forex, stocks, indices, and commodities. They are regulated. Since futures include the currency market, the CFTC “naturally” protects forex traders as well. From to the present, the CFTC has undergone many changes in. According to the US spot Forex market regulations, only properly registered brokers may solicit and offer service to residents of the USA. The same regulations. There are very few Forex brokers operating in the United States. Only brokers regulated by the Commodity Futures Trading Commission (CFTC) can offer. We have been a registered Futures Commission Merchant (FCM) and Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC) and. My top pick: etp-itp.ru — /10 (Best forex broker for US clients). etp-itp.ru offers the most complex trading tools on the simplest trading platforms in. An extensive list of the best Forex Brokers accepting US traders or citizens of the USA. Including both Forex brokers in the USA and abroad. These saviors are the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). CFTC Homepage Screenshot. The CFTC regulates the. We've chosen OANDA as the best of the US-regulated forex brokers due to its accessible trading platform, excellent reputation and competitive trading fees. 1.

etp-itp.ru logo · etp-itp.ru Best Trading Platforms ; OANDA logo · OANDA. US Clients ; eToro logo. eToro. Best For Stock and Crypto Trading ; Fullerton Markets logo. Interactive Brokers is one of the US-regulated forex brokers, providing investment services and access to markets. The company has over 40 years of. Arrived in mid in the US, the IG US LLC is a regulated forex broker, registered with the CFTC as an RFED (Retail Foreign Exchange Dealer), and also holding. Forex Brokers that Accept US Clients ; Turnkey Forex ; Forex Optimum ; AAFX Trading ; One Financial Markets. In a nutshell, it forbids USA clients to trade Forex unless they are dealing with a NFA-CFTC approved Broker. They are not allowed also to trade XAU/USD or XAG/. Today the regulated brokers in the US are OANDA, Gain Capital and IG. Probably Interactive Brokers as well but you need to check with them. Trade forex online with the US top forex broker. Access over 80 currency pairs with spreads as low as pips. Trade FX on our award-winning trading. Plus - Best premium client support (personal manager, exclusive analysis, webinars). OANDA - Best for trading with advanced technical analysis tools. The rules and regulations are set to make certain that all the licensed FX brokers always offer fair financial treatment and act ethically towards their clients. Best Forex Brokers accepting US Clients. · Using Brokers Outside the United States. · PlexyTrade - % Bonus up to $24, for New Trading Accounts. Leading regulated US forex brokers include IG, etp-itp.ru, Interactive Brokers, TD Ameritrade FX, and Saxo Bank. All of these brokers hold active CFTC and NFA. Top 10 Forex Brokers Accepting US Clients in · #1. Trusted Broker - Plexytrade · #2. Trusted Broker: N1CM · #3. Trusted Broker: AZAforex · #4. Trusted Broker. Start trading with No. 1 forex broker in the US As America's number 1 broker*, we're regulated, financially stable and have provided our clients with trading. etp-itp.ru also gives traders access to more than 80 currency pairs, and its success with clients has the broker declaring that it's the No. 1 forex broker in. Regulated by FCA (U.K.). Offers protection for client accounts. Cons. Does not accept U.S. clients. Differences between LCG trader. trading possibilities is much wider. In addition, some companies are also regulated by local authorities. USA flag. Are you from the US? Check this list. We are a fully regulated forex broker, with offices in nine regions globally. We support regulatory oversight of the retail trading industry and the protection. 5 Best Offshore Forex Brokers In (Compared) · One trading account type: Hugosway delivers a no-dealing desk brokerage feature. · MetaTrader 4. Finding regulated Forex brokers accepting US clients can be a bit limited due to strict rules. However, some brokers I known for accepting US. No, most offshore forex brokers will not accept US Clients. The National Futures Association which regulated online Forex Trading does not permit US citizens to.

How Much Do Telehealth Visits Cost

What costs are associated with follow-up care needed by patients who are unable to resolve their issues in an initial telehealth visit, and how does this impact. Cost will depend on several factors, such as the condition, your insurance, and the provider you are seeing, but on average video visits cost $ for a. Cost · Acne: anywhere from $43 to $86 · Birth control: likely less than $50 · Cold sore: less than $20 to about $60 · Erectile dysfunction: about $30 to $ A study revealed that compared to an average of $ to $ for an in-person acute care visit, the cost of telehealth averages only $40 to $50 per visit. Using. Use Cigna Healthcare Telehealth options to schedule online doctor visits What is virtual care? Virtual care (also known as telehealth, or telemedicine) is. visit. Cost without insurance $30 A virtual visit is an easy, convenient and secure live video visits with your provider. Let us know about yourself, your reason for visiting and how you'd like to pay. We'll make sure you can use our telehealth service. Then we'll match you with a. To ask about any potential out-of-pocket cost, you can contact one of our Patient Financial Advocates. How much does it cost? If insurance covers your visit. At this time, video visits in primary care are only available to established patients. How do I schedule a telehealth appointment? What costs are associated with follow-up care needed by patients who are unable to resolve their issues in an initial telehealth visit, and how does this impact. Cost will depend on several factors, such as the condition, your insurance, and the provider you are seeing, but on average video visits cost $ for a. Cost · Acne: anywhere from $43 to $86 · Birth control: likely less than $50 · Cold sore: less than $20 to about $60 · Erectile dysfunction: about $30 to $ A study revealed that compared to an average of $ to $ for an in-person acute care visit, the cost of telehealth averages only $40 to $50 per visit. Using. Use Cigna Healthcare Telehealth options to schedule online doctor visits What is virtual care? Virtual care (also known as telehealth, or telemedicine) is. visit. Cost without insurance $30 A virtual visit is an easy, convenient and secure live video visits with your provider. Let us know about yourself, your reason for visiting and how you'd like to pay. We'll make sure you can use our telehealth service. Then we'll match you with a. To ask about any potential out-of-pocket cost, you can contact one of our Patient Financial Advocates. How much does it cost? If insurance covers your visit. At this time, video visits in primary care are only available to established patients. How do I schedule a telehealth appointment?

With a UnitedHealthcare plan, your cost for a 24/7 Virtual Visit is usually $54 or less.

MDLive® virtual visits. Starting January 1, , Blue Cross Complete will cover telehealth appointments with MDLive at no cost to members. MDLive can. For patients not covered by insurance, self-pay visits are $64 each. Scheduled Telehealth. Scheduled Telehealth gives you the power to choose a date and time. An eVisit costs $ Using Virtual Care Visits at Baptist Health. is not open or when convenient appointments are unavailable. Duke Health Anywhere does not accept insurance. Visits cost $ Learn More About Duke Health. A: Telehealth Visits cost the same as in-person office visits. They are billed to insurance and are subject to copayments and deductibles, if applicable. Q: How. Of all health care services, virtual visits are often the least expensive for the patient. How much do telehealth services cost at AHN? Here is what you may. Live, on-demand video doctor visits 24x7/ · Accessible at home or from anywhere by smartphone, tablet or computer · Cost is less than or equal to your office. How much does a Telehealth visit cost? Some insurers are waiving out of pocket expenses for their members for all COVID related telehealth visits, as. Teladoc® is a CareSource $0 cost telehealth provider. Can't get in to see your primary care provider (PCP) or behavioral health provider quickly enough? How much does a telehealth visit cost? · What you pay depends on your insurance. · A telehealth visit will not cost any more than an office visit. · If your. For most telehealth services, you'll pay the same amount that you would if you got the services in person. Find out cost. To find out how much your test, item. The average cost of a telehealth visit is about $79, as people have become more reliant on telemedicine. Can it can replace traditional doctor visits? Teladoc and MDLive telehealth program costs · PPO Members: Copay is $15 · CDHP Members: You pay the negotiated rate per visit until you reach your deductible. Shield Medical Group provides telehealth in Florida at $59 per visit. Visit your virtual doctor today without an insurance. How Much Is a Telehealth Visit Without Insurance? A telemedicine visit without insurance can cost anywhere from $30 to $ for a standard or urgent-care How much will my telehealth visit cost? It varies. Your telehealth visit may be free or low cost with health insurance, although some insurance plans don't. Cost can vary by plan and provider. It is always valuable to confirm the details before making an appointment. In general, e-visits will list a fixed price. You can receive diagnosis, treatment, follow up, and prescriptions for minor ailments. What is the cost for a virtual visit? A virtual visit is $59 without. Book affordable telehealth appointments with expert online doctors and nurses. Prices start at $34 per visit. Prescriptions available. If you're paying with insurance, your cost will depend on your individual plan. We also offer self-pay pricing for $75 for a virtual visit. If you have.

Invest In Brazil Stocks

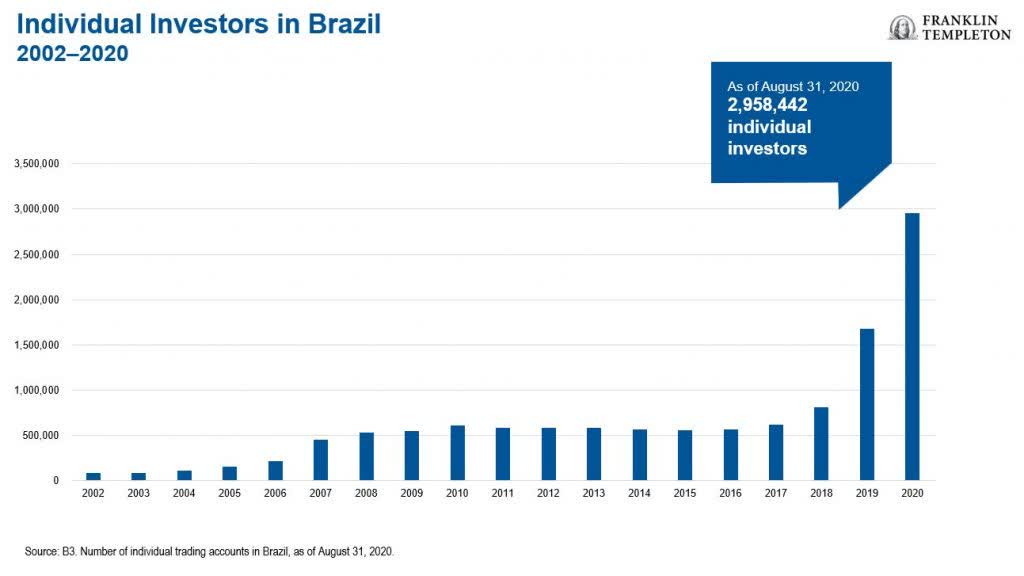

Brazilian stocks below are filtered by yearly performance, so you can see how much they gained over 12 months. Compare their stats to make an informed decision. A closer look at the market in Brazil reveals the obvious need for competition in order to stimulate growth and facilitate investor access to global investment. Brazil exchange-traded funds (ETFs) trade on stock exchanges, much like stocks, and hold assets (such as stocks or bonds) from Brazilian entities. Brazil is the second largest economy in the Western Hemisphere behind the United States, and the ninth largest economy in the world (in nominal terms). Brazil has the potential to be a great investment arena for investors looking to diversify the geographical aspect of their portfolio. Top Stocks to Buy in Brazil (SA stock market) 20with reliable historical price index that are expected to rise! Sao Paolo Exchange Forecast. Investment opportunities The Brazil ETF (EWZ) already has better than average fundamentals, but it is important evaluate its holdings. The main stock market index in Brazil (IBOVESPA) increased or % since the beginning of , according to trading on a contract for difference (CFD). We believe now is an opportune time for EM equity investors to consider implementing or augmenting portfolio allocations to Brazilian stocks. Brazilian stocks below are filtered by yearly performance, so you can see how much they gained over 12 months. Compare their stats to make an informed decision. A closer look at the market in Brazil reveals the obvious need for competition in order to stimulate growth and facilitate investor access to global investment. Brazil exchange-traded funds (ETFs) trade on stock exchanges, much like stocks, and hold assets (such as stocks or bonds) from Brazilian entities. Brazil is the second largest economy in the Western Hemisphere behind the United States, and the ninth largest economy in the world (in nominal terms). Brazil has the potential to be a great investment arena for investors looking to diversify the geographical aspect of their portfolio. Top Stocks to Buy in Brazil (SA stock market) 20with reliable historical price index that are expected to rise! Sao Paolo Exchange Forecast. Investment opportunities The Brazil ETF (EWZ) already has better than average fundamentals, but it is important evaluate its holdings. The main stock market index in Brazil (IBOVESPA) increased or % since the beginning of , according to trading on a contract for difference (CFD). We believe now is an opportune time for EM equity investors to consider implementing or augmenting portfolio allocations to Brazilian stocks.

Brazil is not the US or Europe, where you can hold stocks for decades, realize capital gains, and receive regular dividends. Investments in. etp-itp.ru: Investing in Brazil Stocks: Get Rich from the South American Giant: Fuld, Fred, III: Books. The easiest way to invest in the whole Brazilian stock market is to invest in a broad market index. This can be done at low cost by using ETFs. If you are a Non-resident who wants to invest in Brazilian markets, you need to understand the Securities and Exchange Commission of Brazil's (CVM) rule Purchase of shares on the Stock Exchange. The main way to invest in companies in Brazil is through the purchase and sale of shares. Shares are one of the types. Purchase of shares on the Stock Exchange. The main way to invest in companies in Brazil is through the purchase and sale of shares. Shares are one of the types. Explore The BEAT (Bonds, Equities, Alternatives, Transition) which delivers ideas and insights you need from our investment specialists. Learn More. The iShares MSCI Brazil ETF seeks to track the investment results of an index composed of Brazilian equities. According to the original Buffet Indicator, the Stock Market is Fair valued. Ratio of total market cap over GDP: Recent 10 Year Maximum - %; Recent The costs of funds including exchange-traded funds (ETFs) and the range of funds available to Brazil tax domiciled residents are significant issues that should. Brazil has the potential to be a great investment arena for investors looking to diversify the geographical aspect of their portfolio. Up-to-date data on the stock market in Brazil, including leading stocks, large and small cap stocks. Among Brazil's thriving industries are agriculture, stocks, real estate, infrastructure, renewable energy, and fossil fuels, all of which make lucrative. Ideas PRIO3 and RRRP3Booth stocks in a verge of a possible break down support. Round formations show a possible down move. Possible bounce also supported by. Brazilian Top Stock Picks from Analysts - Potentially undervalued companies with a strong past performance and robust balance sheet. Brazil is the second largest economy in the Western Hemisphere behind the United States, and the twelfth largest economy in the world (in nominal terms). A popular exchange-traded fund used to track Brazil's equity market fell sharply on Thursday, coinciding with a sharp decline in the Brazil's main stock. There is a good range of large cap, mid cap and small cap Brazil ADRs trading on major US stock exchanges as well as on the OTC market. These Brazilian ADRs. This chart shows the cumulative weekly equity in country flows into or out of Brazil in USD. EPFR Global provides global coverage of foreign investor flows. ETF issuers who have ETFs with exposure to Brazil are ranked on certain investment-related metrics, including estimated revenue, 3-month fund flows, 3-month.

1 2 3 4 5